A Guide to Buying a Home to Age-in-Place

If asked about major life changes, most people would probably think of their younger days. While some older citizens are settled since their decades of work and raising children are far behind them, others make significant lifestyle decisions in their golden years, including where they will live if their current home is no longer suitable.

The home they purchased many years earlier might have cumbersome stairs that they struggle to climb, a yard that’s difficult to maintain or more rooms than necessary. Its location may not be suitable either because it’s too noisy and busy or too far from anywhere.

During this time, some seniors seriously consider aging in place. This term refers to older people who choose to live independently in their own homes as they age, rather than entering a residential care community, such as assisted living. A University of Michigan National Poll on Healthy Aging conducted in 2022 asked a sample of seniors nationwide about their preferences regarding aging in place. This study found that 88% of 50-80-year-olds think it’s important to remain in their homes for as long as they safely can.

This guide considers several aspects of aging in place, including the best location to age in place, what seniors should look for in a new home and which professionals can make relocating easier. It also covers several options for buying a home and finding ways to pay for it.

Where Should You Age in Place?

Aging in place can mean different things to different seniors. For some, it means continuing to live in their existing home, often the place where they raised their kids. For others, it means relocating to a new home that’s more suitable for their current and future needs. This frequently, but not always, means downsizing and relocating, sometimes to another city or state. The following section looks at what seniors should consider about aging in place. It also compares two popular options: senior apartments and retirement communities.

Things to Consider About Environment When Aging in Place

Environment is possibly the most important factor when choosing somewhere suitable to age in place. What was once the right home, city or state may no longer be suitable for the older you. For example, you might expect that at some point you’ll no longer be able to drive, making traveling more complicated and time-consuming. Therefore, you should consider what your ideal environment will look like as you age. If you’re fortunate, your current location will satisfy your needs, but if it doesn’t, you may wish to consider relocating. Some things you should think of include:

- Health Care Access: It should be easy for you to get to your doctor or nearest hospital and for medical professionals to come to you in good time.

- Neighborhood Safety: Neighborhoods evolve over time. The one you moved into may not feel as safe as it did. Comparing it with the place you’re thinking of moving to may be worthwhile.

- Visitors: Loneliness and social isolation can cause serious health conditions, so you should consider how frequently your loved ones can visit your home.

- Socializing: Just because you’re aging in place doesn’t mean you want to abstain from socializing. You should consider the proximity of the nearest senior center and other venues where your age group congregates, such as libraries.

- Shopping: If you reside in a rural area and can no longer drive, shopping for groceries may become a problem. Consider how close you are to convenience stores, particularly if you can’t rely on someone to help you out regularly.

- Family: Consider how easy it is for you to visit your family. Also, think about their journey times if you have an emergency.

Things to Consider About Your Personal Preferences When Aging in Place

Your environment is primarily general, but there are also factors specific to you and your lifestyle that should factor into your decision about aging in place. The following list covers some things to consider.

- Grandchildren: Many seniors are grandparents who value the time they spend with their grandchildren. Ask yourself if your current location makes it easier or more difficult to enjoy time with them. It may be that they’re too young to travel without a parent, which could greatly reduce visiting opportunities.

- Hobbies: Retired seniors often spend their free time indulging in hobbies. Is your current location a problem or a benefit? For example, someone who likes fishing may want to be close to a river or lake and won’t want to move somewhere too far from either.

- Travel: Do you expect to travel frequently to places you like? If so, use Google Maps to gauge the distance and journey times to the places you’ll visit most. Would moving somewhere else reduce the time you spend in the car enough to justify relocating?

- Home Modifications: Will your home need to be modified? Perhaps there’s a staircase that you might one day need a stairlift to ascend. If the costs of modifying your home are more expensive than moving to somewhere more senior-friendly, it may be time to consider relocating.

- Home Maintenance: Although you may not be struggling to maintain your home inside and out, what will happen as you age or if you sustain an injury? Is there someone nearby who can help regularly, or will you have to pay a company to maintain your home for you?

- In-Home Care Services: Will you need in-home care? If so, how will you pay for it? Original Medicare might pay if you need skilled nursing, but it won’t pay for an agency to help with activities of daily living, such as bathing and dressing. To get help from Medicaid, you’ll need to satisfy the strict qualifying criteria.

Senior Apartments Versus Retirement Communities for Aging in Place

Seniors can age in place in their own homes, but there are two popular alternatives. Often marketed as 55+ communities, senior apartments and retirement communities are similar, but the differences are noticeable. The following table compares both of these options.

Senior Apartments

Retirement Communities

Overview

-Multi-unit properties where residents are restricted by age (normally 55 or 62)

-Must comply with The Fair Housing Act

-Residents rent their apartments

-Resort-style community

-Residents must be aged 55 or older (communities may have different age restrictions)

-Residents usually have the option to buy or lease their home

Housing/Room Type

-Typically 1- or 2-bedroom apartments

-1-, 2- or 3-bedroom apartments

-Stand-alone Villas

-Cottages

-Duplexes

Costs

-Similar to standard rental costs for an apartment

-Some are subsidized to make them more affordable for low-income seniors

-Monthly fees vary because there are so many living options (e.g. apartments, villas, etc) as well as community amenities.

-Monthly fees can be anywhere between $1000 and $10,000 per month to an array of factors, such as if the senior has bought the home and the community’s wow factor.

-Home a grounds maintenance fees are usually included when the home is leased. Seniors who buy usually pay an additional monthly fee )up to $1,500 for these services.

Provision of Care

-Care services are uncommon because senior apartments are for relatively active adults.

-Some may provide very basic care, but don’t expect it.

-On-site services aren’t standard, so you’ll need to check with an individual community if you require basic levels of care.

-Resident may be able to hire an in-home care service agency (check with your community)

Typical Amenities

-Usually a clubhouse with space for social activities

-On-site shared dining

-Library

-Common Interest Groups

-Organized Social Activities

Beauty Salon/Barbershop

-Game Room

-Fitness Center

-Swimming Pool

-Spa

-Tennis Courts

-Gold Course (sometimes included in luxury communities

Typical Lifestyle Services

-Grounds, building and apartment maintenance services

-Housekeeping

-Laundry

-Linens

-Concierge services

-Transportation

-meal preparation

What to Look for in a Home for Aging in Place

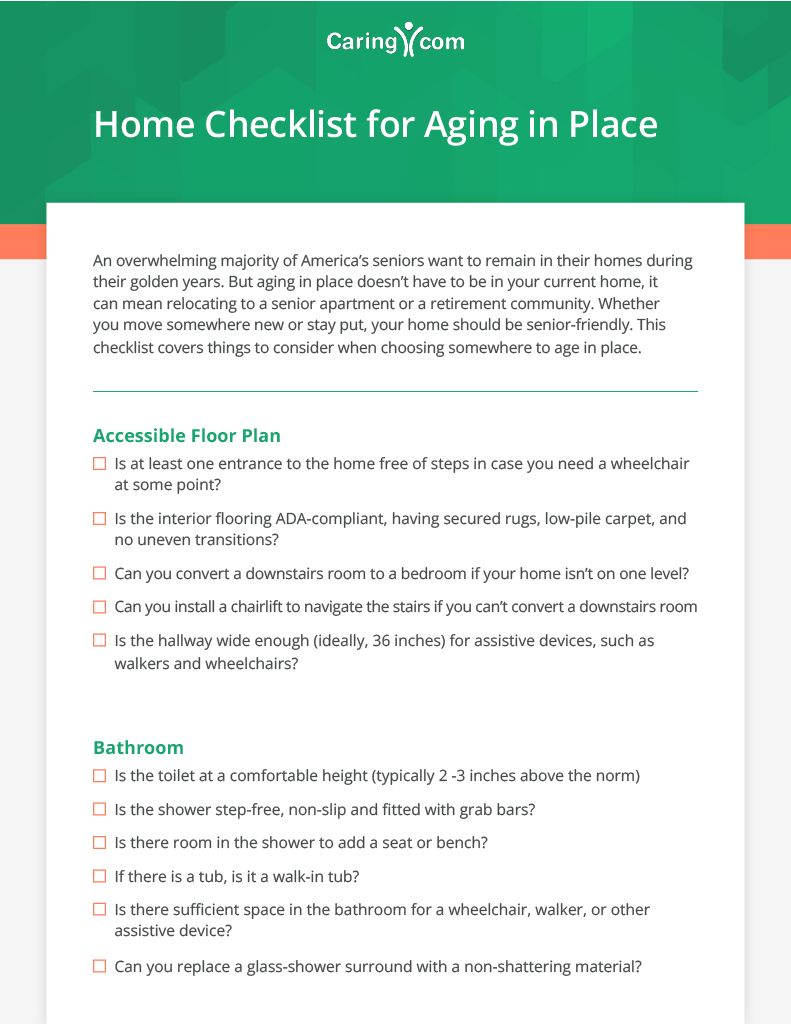

When you’re looking for a home where you can age in place, whether that be in an all-ages community or a retirement community, there are certain things you should be on the lookout for to help ensure it’s a safe location to age in place. Bring the below printable checklist with you as you tour potential residences to see what safety features for aging in place the home does or does not have.

Working with Professionals to Help You Buy a Home

You may have bought and sold a property before, so you’re probably aware of the benefits of involving professionals to smooth the process and help you avoid potential pitfalls. This may be a real estate agent, broker or insurance agent. You should also consider working with professionals who specialize in helping seniors relocate to new homes and 55+ communities. The following three are possibly the most important.

Senior Home Safety Inspectors

A Senior Home Safety Inspector provides a comprehensive assessment of their client’s existing residence or potential new home. The inspection’s purpose is to discover possible hazards and suggest improvements to make the home more senior-friendly. A typical inspector will look for:

- Tripping hazards, such as slippery flooring, floor seams in entryways and loose outdoor paving

- Electrical concerns, such as faulty wiring and a lack of smoke and carbon monoxide alarms

- Plumbing issues, including baths that may be difficult to use without falling

- Door width and ramps if the senior uses a wheelchair

- Stairs and railings that may be hazardous due to loose carpeting or shaky banisters

- Round doorknobs and faucets the senior struggles with that can be replaced by lever-style alternatives

Senior Real Estate Specialists

A Senior Real Estate Specialist (SRES) is a Realtor recognized by the National Association of Realtors as someone who specializes in helping seniors buy and sell homes. An SRES Realtor can help seniors deal with aspects of buying and selling that are specific to their age group. For example, they can advise on the pros and cons of 55+ communities they have experience with, develop strategies for downsizing and arrange and coordinate essential home repairs and staging.

An SRES-certified Realtor will also have knowledge of estate planning and relationships with local financial planners who specialize in retirement planning. The National Association of Realtors has a comprehensive database of the country’s SRES-certified realtors that seniors can access for free.

Senior Move Managers

A Senior Move Manager is someone who specializes in helping seniors relocate, which includes the emotional and practical challenges of moving. The following list includes some of the services they offer although these can vary depending on the senior’s needs.

- Designing an age-in-place plan that may include relocation

- Developing a plan to help the senior downsize to a more suitable living space

- Arranging the disposal of items the senior won’t need or want in their new home while making sales as profitable for the senior as possible

- Arranging the storage and shipment of the senior’s possessions

- Organizing professional packing and unpacking services

- Services related to moving home, such as finding a Realtor and preparing the home for sale

If someone you know has had a good experience with a Senior Home Manager, you should consider asking them for advice. To find a Senior Home Manager in your area, check out the search tool provided by the National Association of Specialty & Senior Move Managers.

How to Pay for a Home to Age in Place

Ultimately, paying for the home where you want to age in place will likely be your biggest concern. As previously mentioned, you can’t rely on Medicare, Medicaid or long-term care insurance to cover your costs. However, you have options depending on your income, credit score and available cash. The following lists some options.

- VA Housing Assistance: Veterans and surviving spouses who satisfy eligibility criteria may be eligible for a VA direct or VA-backed loan to buy their homes.

- Supportive Housing for the Elderly Program: This program from HUD helps seniors on very low incomes get the financing they need to purchase homes specifically designed and maintained for older citizens.

- Mortgage: The Equal Credit Opportunity Act means a financial institution can’t discriminate based on the applicant’s age. If you can prove a consistent monthly income post-retirement (usually for three years), the institution must seriously consider your application.

Finally, you should get independent financial advice before entering any financial agreement. If you can, find an adviser with experience helping seniors buy homes in retirement communities.

Find a Retirement Community Near You Where You Can Age in Place

If you want to live in a community of other older adults with whom you can socialize, enjoy shared community spaces, and form friendships, a retirement community may be the best option for you to age in place. As opposed to buying a downsized home in a standard all-ages communities, retirement communities offer unique social benefits.

When choosing a retirement community, first decide on a price point and create a checklist of what your ideal facility must have and what you’d like, but are open to compromise on. Consider its location and if it makes it easy to visit surrounding attractions and for loved ones to visit you. Also think of the facility’s ability to satisfy your educational, social and spiritual needs.

Book a visit with each facility that meets your criteria, ideally that coincides with important daily events, such as mealtimes and classes, so you can see how it handles busy periods. If possible, try the food. Ask questions on an array of subjects, such as security, staff training and how the facility deals with emergency situations. Following these suggestions should help you narrow down your choices to one or two facilities, which should make it easier for you to decide and be confident with your decision.

Here, you can read an overview of some retirement communities throughout the U.S. This is not a complete list, but can help you understand your options. To learn more about the retirement communities in your area, you can search Caring.com to find facilities by city, state or zip or call (800) 973-1540 for professional assistance at no cost to you.